Introducing the Possibility: Can People Released From Bankruptcy Acquire Credit Scores Cards?

Understanding the Impact of Personal Bankruptcy

Upon filing for bankruptcy, individuals are challenged with the substantial effects that penetrate numerous elements of their financial lives. Insolvency can have a profound effect on one's credit rating, making it testing to gain access to debt or financings in the future. This financial tarnish can stick around on credit scores records for a number of years, affecting the person's ability to secure beneficial rates of interest or financial opportunities. In addition, personal bankruptcy may result in the loss of possessions, as particular properties may need to be liquidated to pay off lenders. The psychological toll of bankruptcy ought to not be taken too lightly, as individuals may experience sensations of sense of guilt, tension, and shame because of their financial circumstance.

Moreover, personal bankruptcy can limit employment possibility, as some employers conduct credit score checks as component of the employing process. This can position an obstacle to individuals looking for new work leads or profession advancements. In general, the impact of personal bankruptcy extends beyond financial restraints, affecting different aspects of an individual's life.

Factors Impacting Credit History Card Authorization

Obtaining a credit report card post-bankruptcy is contingent upon different essential variables that considerably affect the authorization process. One vital factor is the candidate's credit rating. Complying with bankruptcy, individuals often have a low credit history because of the unfavorable effect of the bankruptcy declaring. Bank card companies normally search for a credit history that shows the applicant's ability to take care of credit score sensibly. An additional vital consideration is the applicant's income. A secure revenue assures charge card companies of the individual's ability to make prompt settlements. In addition, the size of time because the personal bankruptcy discharge plays an essential duty. The longer the period post-discharge, the much more desirable the chances of approval, as it suggests financial stability and responsible credit actions post-bankruptcy. In addition, the kind of bank card being gotten and the issuer's details requirements can also influence approval. By very carefully considering these variables and taking steps to reconstruct debt post-bankruptcy, individuals can enhance their potential customers of acquiring a credit score card and functioning in the direction of economic recovery.

Actions to Restore Credit Report After Insolvency

Restoring credit score after bankruptcy requires a tactical strategy focused on monetary self-control and regular financial obligation monitoring. One effective method is to acquire a guaranteed credit scores card, where you deposit a particular amount as collateral to establish a credit report limitation. Additionally, think about ending up being an authorized customer on a family participant's credit score card or exploring credit-builder car loans to additional enhance your debt rating.

Guaranteed Vs. Unsecured Credit Rating Cards

Complying with bankruptcy, individuals often take into consideration the option in between secured and unsecured credit report cards as they intend to rebuild their credit reliability and economic security. Secured credit rating cards call for a cash money deposit that serves as collateral, commonly equivalent to the credit score restriction given. Inevitably, the option in between secured and unprotected debt cards ought to line up with the person's monetary goals and ability to take care of credit scores sensibly.

Resources for Individuals Seeking Credit History Reconstructing

For individuals aiming to boost their credit reliability post-bankruptcy, checking out offered resources is crucial to efficiently browsing the credit report restoring procedure. secured credit card singapore. One useful source for people seeking debt restoring is credit score therapy firms. These companies provide financial education, budgeting support, and personalized credit report enhancement strategies. By collaborating with a credit scores counselor, people can gain insights into their debt records, discover techniques to improve their credit history, and get assistance on managing their funds effectively.

Another practical source is credit rating surveillance solutions. These solutions permit people to maintain a close eye on their credit report records, track any kind of inaccuracies or modifications, and detect potential signs of identity burglary. By monitoring their credit rating routinely, individuals can proactively attend to any kind of issues that may make certain and develop that their credit rating details is up to day and precise.

In addition, online devices and sources such as credit scores rating simulators, budgeting applications, and financial proficiency web sites can offer individuals with useful information and devices to help them in their credit scores reconstructing journey. secured credit card singapore. By leveraging these sources successfully, people discharged from insolvency can take meaningful actions towards boosting their this link credit report health and protecting a much better financial future

Verdict

Finally, people released from bankruptcy might have the possibility to get credit scores cards by taking actions to restore their credit history. Elements such as credit rating earnings, background, and debt-to-income ratio play a significant role in charge card authorization. By understanding official website the influence of insolvency, picking between safeguarded and unsecured bank card, and utilizing sources for credit history rebuilding, individuals can improve their creditworthiness and possibly obtain accessibility to bank card.

By working with a credit counselor, individuals can obtain understandings right into their credit history records, find out approaches to enhance their credit report scores, and receive guidance on managing their financial resources successfully. - secured credit card singapore

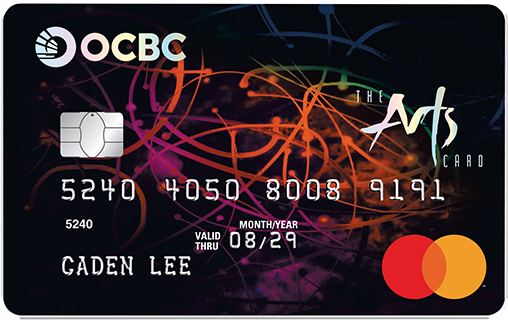

Comments on “How to Choose the Most Reputable Secured Credit Card Singapore for Your Requirements”